Bandhan Small Cap Fund - Direct Plan

An open ended equity scheme predominantly investing in small cap stocks

What are Small Cap Mutual Funds?

Imagine finding the hidden gems of the stock market—companies with immense growth potential. Small cap mutual funds offer you the chance to invest in the rising stars of tomorrow. Let’s explore how these funds can potentially transform your investment portfolio.

Small cap mutual funds invest in a diversified range of stocks from small companies, known as small cap stocks. Small cap companies are defined by market capitalization, with companies ranked below 250th considered small-cap. Small cap mutual funds primarily invest in these companies, aiming for long-term growth potential.

Small cap funds are highly sensitive to market volatility, making them a high-risk investment. However, they offer significant potential for high returns over the long term.

Small cap mutual funds also provide portfolio diversification by investing in companies across various sectors. These companies often have higher growth potential and may scale more quickly compared to mid-cap and large-cap firms.

- Min Investment 1,000

- Min SIP Amount 100

- Exit Load1%

1% if redeemed/switched out within 1 year from the date of allotment

Scheme is suitable for a minimum investment horizon of more than 5 years

Tier 1 Benchmark : BSE 250 Smallcap TRIAlternate Benchmark : Nifty 50 TRI

- Performance

- Portfolio

- Download

- Details

Performance as on 30th August 2024

| Scheme Names | CAGR Returns (%) | Current value of Investment of 10,000 | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 1 year | 3 year | 5 year | 10 year | 26/02/2020 Since inception | 1 year | 3 year | 5 year | 10 year | 26/02/2020 Since inception | |

| Bandhan Small Cap Fund - Regular Plan - Growth | 74.40 | 29.04 | N.A. | N.A. | 41.00 | 17,467 | 21,504 | N.A. | N.A. | 47,137 |

| 54.26 | 25.90 | 31.75 | 17.06 | 33.70 | 15,445 | 19,983 | 39,762 | 48,386 | 36,203 | |

| 31.90 | 15.60 | 19.37 | 13.59 | 20.10 | 13,200 | 15,456 | 24,262 | 35,825 | 22,848 | |

| ^ Tier 1 Benchmark | ^^ Alternate Benchmark | ^^^ Tier 2 Benchmark | ||||||||||

This fund is managed by Mr. Manish Gunwani (w.e.f 28/01/2023), Mr. Kirthi Jain (w.e.f 05/06/2023), Mr. Harsh Bhatia (w.e.f 26/02/2024)

View fund performance of other funds managed by Mr. Manish Gunwani, Mr. Kirthi Jain, Mr. Harsh Bhatia

Past performance may or may not be sustained in future.

Regular and Direct Plans have different expense structure. Direct Plan shall have a lower expense ratio excluding distribution expenses, commission expenses etc.

Taxation:

For taxation, please refer the link : https://bit.ly/46xQzi1

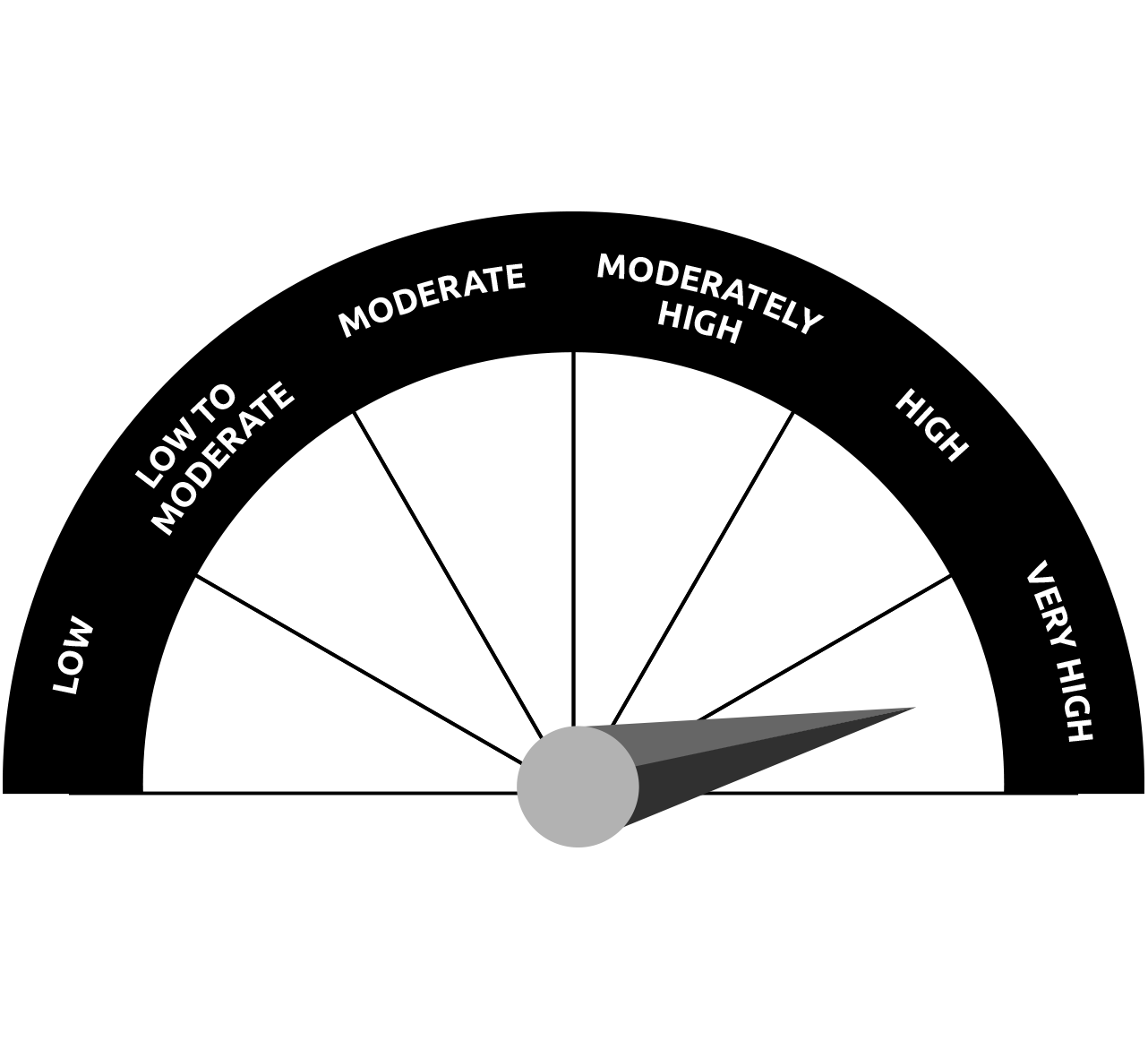

Bandhan Small Cap Fund

(Scheme Risk-o-meter)

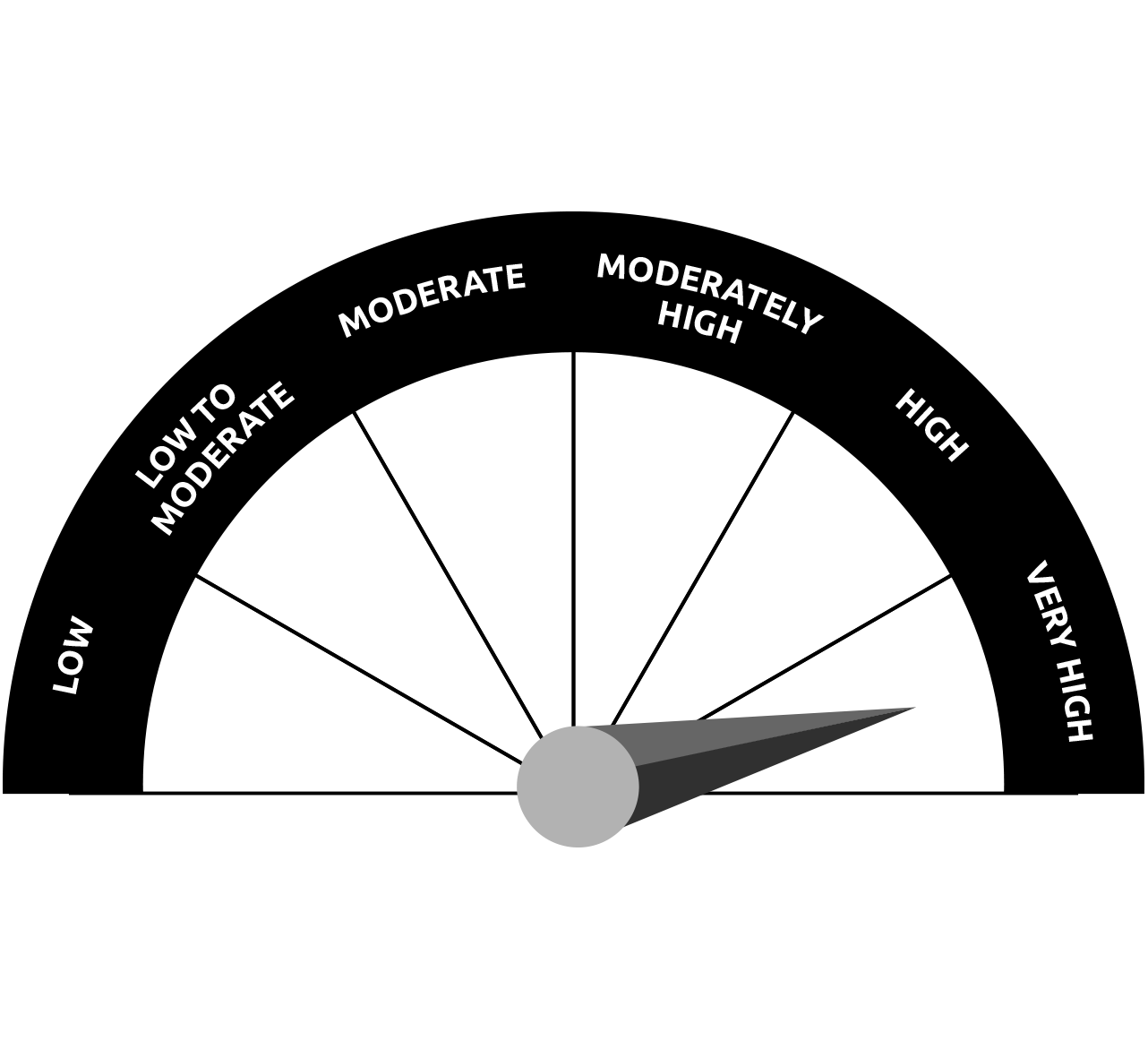

BSE 250 Smallcap TRI

(Tier 1 Benchmark Risk-o-meter)

This product is suitable for investors who are seeking* :

- To create wealth over long term.

- Investment in equity and equity related instruments of small cap companies

Should You Invest in Small Cap Funds?

Small cap mutual funds are ideal for investors with a high-risk appetite and a long-term investment horizon. These funds are designed for those looking to potentially earn higher returns by investing in small-cap companies..

Small Cap vs Large Cap Mutual Funds:

● Large-cap funds carry relatively lower risk, while small cap funds are high-risk investments.

● Small cap funds offer greater growth potential, while large-cap funds provide relatively stable returns.

Small Cap vs Mid Cap Mutual Funds:

● Mid-cap funds are less risky than small cap funds.

● Small cap funds offer greater growth potential, while mid-cap funds offer moderate growth potential.

FAQs on Small Cap Mutual Funds

What is a small-cap fund?

Small cap funds are mutual funds that invest in small cap companies. Small cap companies are defined in terms of market capitalisation. These small cap companies have greater potential and scope to grow, potentially offering significantly higher returns further allowing for wealth generation over the long-term.

Is it good to invest in small cap funds?

Small cap funds can be a good option for investors who are not risk-aversive. Small cap funds are high-risk but also have the potential to give high returns. They are also suitable for investors looking to create wealth over the long-term.

How risky is a small-cap fund?

Small-cap mutual funds are a high-risk investment option and are not suitable for risk-averse investors. They are more volatile and less liquid than midcap and large cap funds.

What are the disadvantages of small cap funds?

Small cap mutual funds are more risky and volatile in comparison to mid and large cap funds. Moreover, they have low liquidity.

How long should one be invested in a small-cap fund?

Small cap mutual funds are susceptible to market fluctuations and can be a risky short-term investment. They are, thus, considered a long-term investment option. It is necessary to give these small companies enough time to grow to generate potentially better returns. The recommended period to hold investment in a small-cap fund is a minimum of five years, although this number may differ depending upon the investor and their goals.

What is the difference between a small cap fund direct growth plan and regular plan?

All mutual funds have direct growth plans and regular plans. In a direct growth plan, investors invest directly with the AMC. In a regular plan investors can invest via an intermediary, such as a broker or financial advisor.

Do small-cap funds give high returns?

Small cap mutual funds invest in stocks of small cap companies which are defined on the basis of market capitalisation. These small cap companies have greater potential and scope to grow in the long-term. Although small cap funds are risky in nature, they have the potential of offering significant long-term returns.

More about Bandhan Small Cap Fund